➥ Search Our Full HVAC Rebates Database

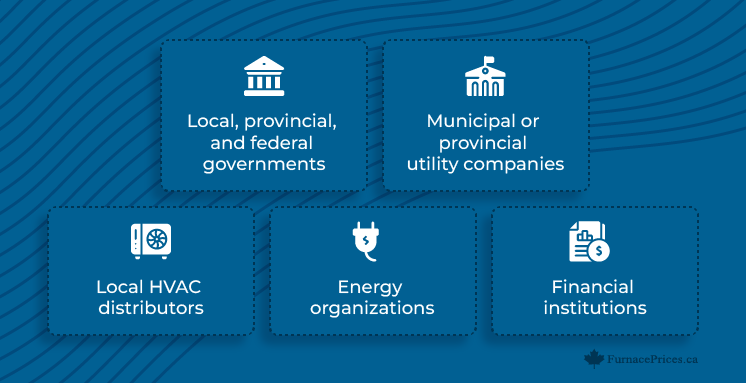

- Local, provincial, and federal governments

- Municipal or provincial utility companies

- Local HVAC distributors

- Financial institutions

- Energy organizations

How to Apply for Government HVAC rebates:

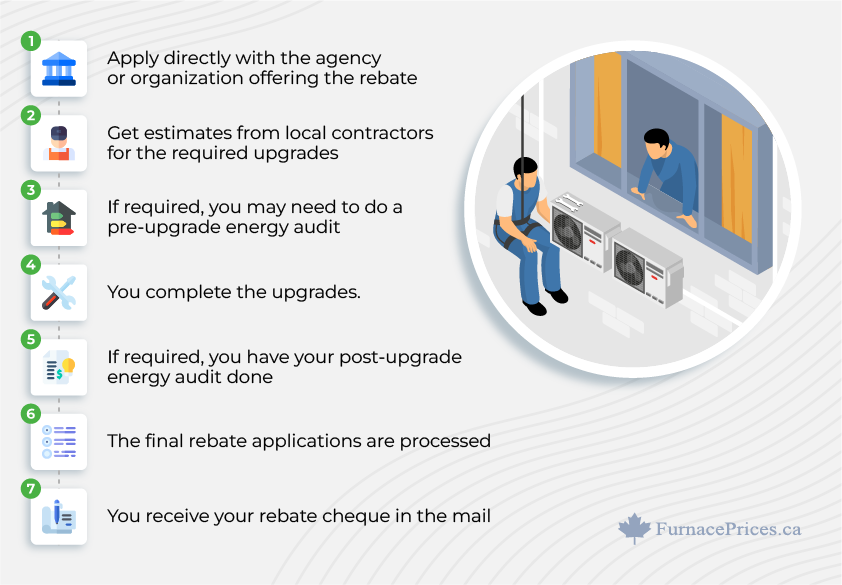

- In most cases, you may need to apply directly with the agency or organization offering the rebate first.

- You would then get estimates from local contractors for the required upgrades that you are interested in (e.g. quote on a new furnace).

- If required, you may need to do a pre-upgrade energy audit from a qualified company.

- You complete the upgrades.

- If required, you have your post-upgrade energy audit done.

- The final rebate applications are processed (sometimes the contractors you dealt with help with this portion).

- You receive your rebate cheque in the mail.

Find out if you qualify for HVAC rebates!

Getting Government Rebates [VIDEO]

Federal Rebates for Furnaces, Heat Pumps & Other HVAC Systems

Canada Greener Homes Loan Program – $40,000

How to Apply

Ontario Rebates for Heating & Cooling

Province-Wide Residential Rebates

In January 2025, the province of Ontario announced an updated energy efficiency framework that includes new rebates for heat pumps, solar panels, and more.

Including:

- $600 for a home energy assessment

- $100 per new window and door

- Up to $8,900 for insulation

- Up to $250 for air sealing

- $75 for a smart thermostat

- $500 for a heat pump water heater

- Up to $7,500 for a cold climate air source heat pump

- Up to $12,000 for a ground source heat pump

- Up to $5,000 for rooftop solar panels

- Up to $5,000 for battery storage systems

Other general energy efficiency rebates

- Home energy assessment: Up to $600

- Insulation: Up to $10,000 for insulation for attics, basements, crawl spaces, and exterior walls

- Air sealing: Up to $1,300 for achieved air sealing

- Windows: Up to $325 for each window, door, or skylight you replace

- Furnaces: $250 to upgrade to a high-efficiency condensing natural gas furnace, as long as you complete two other upgrades

- Space and water heating: Up to $7,800 for heat pumps water heaters

- Thermostats: Up to $125 for upgrading to a smart thermostat

- Solar panels: Up to $5,000

- Weatherproofing: Up to $1,625

Affordable multi-family housing rebates:

- Boilers

- Water heaters

- Make-up air units

- Low-flow showerheads

- In-suite HRVs and ERVs

- Whole-building ERVs and HRVs

Save on Energy’s Energy Affordability Program

- ENERGY STAR LED light bulbs

- Window air conditioner

- Clothes line

- Weatherstripping

- Smart thermostat

- Block heater

- Energy audit

- Showerhead

- Faucet aerators

- LED night light

- Energy-efficient refrigerator

- Smart power strip

- Additional attic or basement insulation

- Cold climate air source heat pump

- Energy-efficient freezers

- Energy-efficient dehumidifiers

Ontario Renovates Program

- Door and window replacements

- Heating system and chimney repairs or upgrades

- Repairs or improvements to the foundation, roof, walls, floors, siding, and ceilings

- Accessibility improvements involving ramps, handrails, chair and bath lifts, cues for doorbells and fire alarms, and height-adjustable countertops

- Electrical, plumbing, septic, and well upgrades

- Chair and bath lift installation

- Low- and dual-flush toilet upgrades

- Structural improvements

- Increased insulation

- Fire and other safety system upgrades

The terms, conditions, eligibility criteria, and loan amounts vary based on the city, municipality, or county that’s offering the program. Most regions haven’t announced a closing date. Here’s a list of places where homeowners can take advantage of the Ontario Renovates Program:

- Brantford: Up to $20,000 in forgivable loans.

- Nipissing District: Up to $25,000

- Ottawa: Up to $20,000 in forgivable loans and grants.

- Thunder Bay: The city has a $5,000 grant that’s forgiven at 10 percent each year.

- Simcoe County: Up to $15,000 per unit.

- Hamilton: Up to $25,00 in forgivable loans.

- Haldimand and Norfolk: Up to $10,000, plus a $5,000 grant for accessibility repairs.

- Cornwall: Up to $12,000.

Smart Thermostat Discount

Get Quotes

How soon are you looking to buy?*

Residential Rebates by City/Region

- Purchasing high-efficiency boilers, furnaces, air conditioners, and water heaters

- Replacing doors and windows

- Air sealing and insulation

- Purchasing air-source heat pumps

- Installing geothermal or solar hot water systems

- Replacing toilets

- Drain-water heat recovery systems

- Solar hot water systems

- Rooftop solar PV panels

- Electric vehicle charging stations (Level 2)

- Battery storage

- $100 per square meter to install a green roof (up to $100,000)

- $1,000 for a structural assessment before installing a green roof

- $2 to $5 per square meter for a cool roof (up to $50,000)

Commercial Rebates

- Destratification fans: $100 per unit

- Heat recovery ventilators: $0.50 to $1.25/CFM for new devices

- HRVs: $0.25 to $0.75/CFM for upgraded devices

- Energy recovery ventilators: $1.00 to $1.75 for new devices

- ERVs: $0.50 to $1.15 for upgraded devices

- Air curtains: $200 to $500 for pedestrian doors

- Air curtains: $3,250 to $8,750 for shipping doors

- Door dock seals: $950 to $1,650

- Condensing make-up air units: $0.50 to $1.00/CFM

Alberta Rebates for Heating & Cooling

Residential Rebates by City

- Refrigerator: $300

- Clothes washer: $150

- Ventless Dryer: $150

- Dishwasher: $150

- Door replacement: $100 per door

- Window replacement: $100 – $200 per window

- Furnace: $500

- Heat pump: $750

- Heat pump water heater: $500

- Solar hot water heater: $650

- Home energy audit: $500 or one third of cost (whichever is lower)

British Columbia Rebates for Heating & Cooling

Province-Wide Residential Rebates

- Windows and doors: Up to $2,000 to install energy-efficient windows and doors (more info from FortisBC)

- Insulation: Up to $5,500 to upgrade insulation (more info from FortisBC)

- Heat pumps: $1,000 to $2,000 for a new air source heat pump

- Water heater: $1,000 for a new electric heat pump water heater

- $1,300 rebate plus a $1,000 bonus for an ENERGY STAR natural gas furnace/boiler

- $1,700 rebate plus a $1,000 bonus for an ENERGY STAR natural gas furnace/boiler plus a standalone water heater (you get an additional $200 to $1,000 for the water heater)

- $1,700 rebate plus a $1,000 bonus for a combi boiler

- $1,700 rebate plus a $1,000 bonus for a P9 certified combination heating and hot water system

- A $6,500 heat pump loan at an interest rate of 1.9 percent

- Eligible high-efficiency air source heat pump rebates of $1,200 or $2,000

- Rebates up to $5,000 for income-qualified customers

- A $50 rebate for annual heat pump maintenance

- A $,1000 rebate for a heat pump water heater

- High-efficiency natural gas furnace

- ENERGY STAR refrigerator

- Insulation

- LED lights

- Showerheads and faucet aerators

- Weatherstripping

Residential Rebates by City

Electric Heat Pumps and Heat Pump Water Heaters

| Municipality | Electric Heat Pump Space Heating Top-Up | Electrical Service Upgrade Top-Up | Electric Heat Pump Water Heater Top-Up |

|---|---|---|---|

| Vacouver | $4,000 | $1,500 | $1,000 |

| North Vanvouver | $2,000 | $500 | $1,000 |

| West Vancouver | $2,000 | ||

| New Westminster | $350 | ||

| Kamloops | $350 | $500 | $350 |

| Whistler | $350 | $500 | $1,000 |

| Kelowna | $2,000 | $1,500 | $1,000 |

| Saanich | $350 | $500 | $350 |

| Sidney | $350 | $500 | $350 |

| Royal | $350 | ||

| Nanaimo | $350 | $500 | $350 |

| Powell River | $350 | $500 | $350 |

| Campbell River | $350 | ||

| Cowichan | $350 | $500 | $350 |

| Duncan | $350 | $500 | $350 |

| Comox Valley | $350 | $500 | |

| Squamish | $350 | ||

| Coquitlam | $350 | $500 | $350 |

| Chilliwack | $2,000 | $1,500 | $1,000 |

| Port Moody | $350 | $350 | $500 |

Commercial Rebates

- $2,500 to $3,750 for storage tank natural gas water heaters

- $15/MBH rebate for a hot water supply boiler

- $2,500 for high-efficiency tankless water heaters

Manitoba Rebates for Heating & Cooling

Province-Wide Residential Rebates

- Energy check-ups: Free home energy assessments

- Insulation: Free insulation (including insulation) for attics, walls, and basements

- Furnaces: A free natural gas furnace when you replace a standard- or mid-efficiency furnace

- Furnaces: A mid-efficiency furnace that costs just $25 a month for five years

- Boilers: A $5,000 rebate on a high-efficiency natural gas boiler

- Efficient products: Free energy-efficient equipment, including LED lights, showerheads and aerators, and air-sealing products

New Brunswick Rebates for Heating & Cooling

Province-Wide Residential Rebates

- Up to $3 per square foot of insulation

- $50 for windows, doors, and skylights

- $200 for an HRV

- $200 per kilowatt of solar photovoltaic

- Up to $550 for air sealing

- Up to $2,000 for a heat pump

- $350 for a gas water heater

- $550 for a heat pump water heater

- Up to $2,250 for building envelope upgrades

- Up to $50 for ENERGY STAR windows/doors/skylights

- Up to $2,000 for a heat pump

- $200 per HRV

- $350 for a gas water heater

- $550 for a heat pump water heater

Newfoundland Rebates for Heating & Cooling

Province-Wide Residential Rebates

Energy Kits

- ENERGY STAR LED light bulbs

- Switch and outlet insulators

- Draft plugs

- Weatherstripping

- Window insulation film

- Showerhead

- Faucet aerators

- Water heater pipe wrap

- Water heaters: Up to $1,425 for electric water heaters

- R-2000: Up to $10,000 for R-2000 Standard upgrades

- Heat pumps: Up to $10,000 for electric heating systems and heat pumps

- HRVs: Up to $5,000 for HRVs

- Insulation: Up to $5,000 for basement and attic insulation upgrades

- Service: Up to $10,000 for service upgrades

- Fireplaces: Electric fireplaces and mantles (no maximum amount for financing)

- Thermostats: Digital and programmable thermostats (no maximum amount for financing)

Insulation and Heat Pumps

Insulation

Air Sealing

Electric Home Heating

- $5,000 to $10,000 for an electric furnace or boiler

- $6,500 to $18,000 for mini- or multi-split heat pumps

- $9,000 to $22,000 for a central heat pump

Commercial Rebates

- Heat pumps: $300 per ton on rooftop air source heat pumps

- ECM motors: Free ECM motor upgrades for the evaporator fans in refrigeration equipment systems

- Thermostats: $20 per programmable thermostat

Nova Scotia Rebates for Heating & Cooling

Province-Wide Residential Rebates

- Heat pumps: $150 to $1,600 for heat pumps

- Wood and pellet heating: $500 to $1,000 (more information)

- Three-element water heaters: $400 to $650

- Solar thermal: $400 to $1,000

- Electric thermal storage: $300 to $2,000

- Variable-speed pool pumps with ENERGY STAR certification

- Dimmer switches

- Smart and programmable thermostats

- LED lights

- High-efficiency showerheads

- Air purifiers

- Dehumidifiers

- Ventilating fans

- Ceiling insulation: Up to $750

- Basement insulation: Up to $1,200

- Exterior wall insulation: Up to $1,500

- Draft proofing: Up to $200

- Heat pumps: $300 to $600 per ton

- Solar: $400 to $1,000 for solar equipment

- Air sealing: $200

- Windows, doors, and skylights: $30 per

- HRVs: $300

Prince Edward Island Rebates

Province-Wide Residential Rebates

- Attic insulation: $2.50–$4.00/100 square feet/R-value increase

- Insulation for above grade walls: $8–$40/100 square feet/R-value increase

- Insulation for below grade walls: $12–$20/100 square feet/R-value increase

- Windows, doors, and skylights: $100 to $200 per opening (maximum $1,000 to $2,000)

- Air sealing (there are rebates available ranging from $100 to $700, depending on whether there’s a 10, 20, or 30 percent improvement in air changes per hour)

- Mini-split air source heat pumps: $1,200 to $2,400

- Central air source heat pumps: $2,500 to $4,500

- Geothermal heat pumps: $4,000 to $7,500

- Electric thermal storage furnace (for City of Summerside Electric Utility customers): $1,500 to $2,750

- Electric thermal storage heater (for City of Summerside Electric Utility customers): $750 to $1,400

- Air-source heat pump hot water heater: $1,000 to $1,800

- Water heaters: Between $500 and $2,750 for electric/solar thermal or tankless units

- HRVs and ERVs: $500 to $900

- Biomass stove: $1,000 to $1,800

- Biomass boiler or furnace: $2,000 to $3,500

Get Quotes

How soon are you looking to buy?*

Quebec Rebates for Heating & Cooling

Province-Wide Residential Rebates

Energy Efficiency Upgrades

- Caulking and/or weatherstripping for windows and doors

- Electrical outlet insulation

- Low-flow showerheads

- Aerators on water taps

- Electronic thermostat

Commercial Rebates

- Improving insulation in walls and roofs

- Air-sealing

- Replacing windows

- Installing thermal screens

Saskatchewan Rebates for Heating & Cooling

Province-Wide Residential Rebates

- Furnaces: $325 to $650 for high-efficiency two-stage or modulating furnaces

- Boilers: $10/MBH (to a maximum of $2,000) for high-efficiency boilers

- Combi boilers: $800 for high-efficiency combi boilers

- HRVs: $100 for ENERGY STAR certified models

- Water heaters: $1,000 for tankless or condensing ENERGY STAR water heaters

- Tank water heaters: $250 for ENERGY STAR certified storage water heaters

Commercial Rebates

- $10/MBH for the first 600 MBH

- $3/MBH beyond the first 600 MBH

- Furnaces: $325 to $650 for high-efficiency furnaces

- Boilers: $10/MBH for new and replacement boilers with an input rating lower than 400 MBH

- Tank water heater: $250

- Tankless water heater: $1,000

- Condensing water heaters: $5/MBH for ENERGY STAR certified replacement units

- Infrared tube heaters: $600 to $1,200

- Heat recovery ventilator: $0.75/CFM

Yukon Rebates for Heating & Cooling

Province-Wide Residential Rebates

Solar Hot Water Heating Systems

Heat Pumps

Wood Heating Systems

- $800 for furnaces or boilers

- $600 for pellet stoves

- $300 for cord wood stoves

Drain Water Heat Recovery Systems

Windows

Heat Recovery Ventilators

Air Sealing and Insulation

- Up to $12,000 for above ground wall insulation

- Up to $10,000 for below ground wall insulation

- $2,000 for slab or flooring insulation

- $2,500 for attic insulation

- Up to $5,000 for air sealing

Residential and Commercial Buildings

Energy Upgrades

- Air sealing

- Attic and wall insulation

- Heat recovery ventilators

- Cold-climate air-source heat pumps

- ENERGY STAR® windows

- Wood or biomass heating systems

- Upgrading or recommissioning HVAC systems (commercial buildings only)

Frequently Asked Questions About Government HVAC Rebates

How do rebates work?

Usually you must pay for the upgrades yourself and you will receive a partial refund in the mail afterwards.In most cases, the process is as follows: – You check for available rebates in your area and carefully study the terms and requirements (you may try speaking to a trusted local contractor for help). You may have to fill out an application first. – If required, you have an energy audit done by a Certified Energy Auditor (CEA) that’s approved by the entity offering the rebate.- You have the upgrades done by a reputable local HVAC contractor (remember, in some cases the company must be registered with the rebate-providing entity. We get contacted daily by people who don’t qualify for the available rebates because they went with the cheapest company they could find or a well-meaning relative. Do your research and ideally opt for an established HVAC contractor)- In some cases the contractor is responsible for applying for the rebates after the work is done, or it may be up to you. Sometimes a final energy audit is required.- You’ll typically receive a reimbursement cheque in the mail The process outlined here is just a general guideline and the details will obviously vary in your case. That’s why it can be a good idea to enlist the help of a local HVAC expert ahead of time to help you through the process of replacing your furnace and getting the rebates.Note that in certain cases (e.g. specific programs for aboriginals) may pay for the upgrades directly but this is relatively rare.

How can I qualify for rebates?

You must almost always apply prior or meet certain pre-installation criteria to qualify. Here some criteria that you may be required to meet (varies by rebate program, obviously):- Work done by a registered company- Pre and post renovation/furnace upgrade energy audit(s)- Purchase of an ENERGY STAR models or other specific model requriements- Certain level of energy consumption decrease achieved- Sometimes more than one upgrade must be done (e.g. new furnace AND water heater)- Must live in eligible region (specific city, province, or be a customer of the gas utility offering the rebate)- If the rebate is being offered by a utility company, your account must most likely be in good standing- Certain programs are geared to low-income homeowners for example, so specific income or other criteria may apply These are just examples; every program will have its own requirements that must be met.

How much can I save?

Typically anywhere from a few hundred dollars to $1000 or more, depending on the rebate program, how many eligible upgrades are completed (furnace, thermostat, insulation, etc). Remember that you must usually pay for the upgrades first and then receive a cheque afterwards.

Can I use the rebate money to pay for the upgrades directly or get the money ahead of time?

In the majority of cases, no. (A limited number of programs may offer “no charge” upgrades but this will be stipulated clearly in the program description.)

When do I receive the money?

Assuming you met all the criteria, you will typically receive the money within a few months of the renovations or HVAC system upgrades being completed.

How will I receive the rebate money?

Often it comes in the form of a cheque in the mail, though in some cases you may get a credit on your natural gas utility company account, for example (e.g. your Enbridge account).

Who is offering these rebates?

Many of them are offered either by government entities, or by utility companies (e.g. Union Gas, BC Hydro, etc), sometimes with funding from the government.

How long will the rebates last/be available?

It varies by rebate program, so it is best to check the exact rebate deadlines in your area for each program. Generally the sooner you can replace your furnace or other upgrade the better to ensure you make the cut.

Do I need to get an energy audit?

In many cases, an energy audit by an approved and Certified Energy Auditor must be completed before AND after the work is done. However certain programs like the Ontario Power Authority/Save on Energy rebates do not require an energy audit (though other conditions do apply).

What’s the catch?

The catch is you must meet a specific list of criteria and other requirements to receive the rebates. And in almost all cases, you must verify that you meet the criteria BEFORE replacing your furnace, A/C or other system. And you must usually pay for the upgrades yourself and be reimbursed afterwards.

What types of products and upgrades are covered?

This varies by rebate program, however the most common products covered are high-efficiency forced-air furnaces, hot water heaters and tankless water heaters, boilers, smart thermostats, and somewhat less commonly central air conditioner replacements, ductless mini-split heat pumps, and HRVs/ERVs.Note that the rebates often also cover various other home energy efficiency upgrades like insulation, windows, etc however this particular rebate guide focuses on HVAC-related rebates.Sometimes a portion of the required energy audit is also covered.

Why are there no rebates in my area?

Because your utility company is mean. Just kidding, the availability of rebates will vary over time, and is most often tied to funding by provincial or local governments.

What if there are no rebates in my area, can I still save money?

Even if there are no rebates available, it may still very well be worth upgrading your furnace, A/C or water heater. Especially if your current system is older than 10-15 years, you may achieve considerable savings on your utility bills/heating/electricity costs, as well as improvements in your home’s comfort level, heating u0026 cooling performance, temperature consistency, fewer repair and maintenance costs, even a reduction in unit noise levels, as well as improving the value of your home.Check out our current deals page to find out about other current offers in your area that can help you save on a new HVAC system!

I already replaced my furnace, AC, etc, can I still get a rebate?

Unfortunately, you must often apply for or meet certain criteria BEFORE the work is done in order to qualify so it’s always best to do your research prior to starting any renovations or removing your old furnace or air conditioner. WE CANNOT HELP YOU IF YOU HAVE ALREADY REPLACED YOUR FURNACE OR OTHER SYSTEM. PLEASE CONTACT THE COMPANY THAT YOU DEALT WITH DIRECTLY.

I want to replace my furnace or other heating u0026 cooling system, where can I find a contractor or company that will get me rebates/more info about them?

You can more information or a free quote including applicable local rebates from local contractors in your area here.

Are rebates worth it?

Getting heating and cooling rebates does take some additional work and time. If you are pressed for time, like if your furnace broke down in the middle of winter, you may not have the luxury of going through the additional steps of applying for rebates, for example.However if you do have the time and inclination, you can often get at least a partial refund of the cost, sometimes over $1000. So if you’re considering upgrading your HVAC system, it is often worth it to at least look into it and ask a trusted local contractor about prior to investing in a new home furnace.With the use of a high efficiency furnace you can cut down on the energy consumption of your home while potentially also improving the comfort level. New ENERGY STAR furnaces, boilers, hot water heaters and other systems are often significantly more energy-efficient than older units. If you want to lower your home’s energy consumption, a furnace is one of the best investments that you can make.Replacing your furnace or making other home renovations can obviously require a costly initial investment. Fortunately there are sometimes provincial government rebates, grants, and tax credits or rebates from your utility company that you can use in order to supplement the cost of a new furnace and recoup some of the money.

Which furnace or A/C brands qualify for rebates?

The brand you choose, whether it’s Carrier, Lennox, Goodman, KeepRite, Amana, Napoleon, or any of the many other manufacturers generally isn’t important. Usually, the most important qualifying factor for the rebates below is that the new system is a high-efficiency, often ENERGY STAR® rated model.

Find out if you qualify for rebates!

Get Quotes

How soon are you looking to buy?*